Depending on the nature of your activities, your organisation can be unwittingly helping a customer (a) move illicit goods or (b) earn, move or spend the proceeds of crime.

It is likely that your organisation is required to mitigate the risk of this happening under applicable law, such as anti-money laundering/counter-terrorist financing (AML/CTF) rules, and your own policies. A failure to do so will give rise to legal or reputational risks.

Examples below demonstrate examples of the FTZ Risk Assessment use cases.

Financial institutions – banks

A bank may be handling proceeds of crime if it provides services to a customer incorporated in an FTZ or trading through an FTZ, including:

- Providing a bank account;

- Accepting a deposit; or

- Issuing a documentary letter of credit.

A bank can also be processing payment for illicit goods if it processes payment for a transaction involving goods being shipped to an FTZ or via an FTZ.

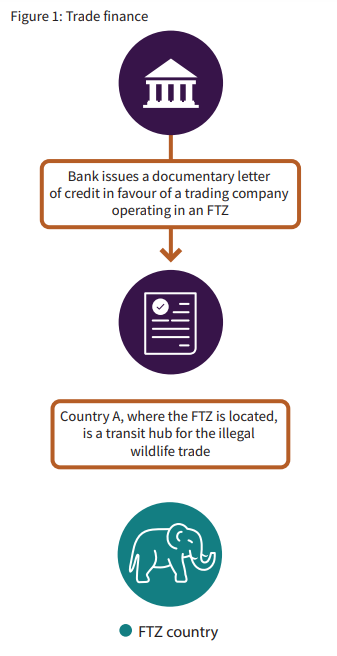

Example A – trade finance

A bank issues a documentary letter of credit in favour of a trading company operating in an FTZ.

The bank is aware that Country A where the FTZ is located is a transit hub for the illegal wildlife trade.

The bank wants to understand money-laundering risks related to this trade financing transaction.

Understanding the risk:

The analysis of the risk factors will facilitate the bank’s assessment of how likely the illegal wildlife trade is in the FTZ. For instance, it is more likely in an FTZ with reduced customs scrutiny and focus on transhipment than in one with reduced income taxation and focus on high-value storage.

Calculating the risk:

The FTZ’s risk score will reflect its overall risk profile and thus help determine whether enhanced due diligence is necessary.

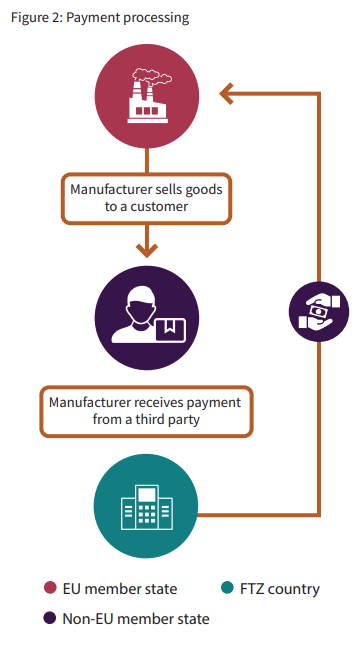

Example B – payment processing

The bank’s customer is a manufacturer based in an EU member state. The manufacturer sells goods to a customer in a non-EU Eastern European country but receives payment from a third-party company incorporated in an FTZ in a Middle Eastern country.

When asked by the bank, the manufacturer explains it has no control over how the purchaser makes the payment. When the bank prompts the manufacturer to inquire with the purchaser, the manufacturer relays the explanation that the purchaser structured the payment so as to benefit from better exchange rates. Open-source research suggests the explanation is implausible.

The bank wants to understand money-laundering risks related to the transaction as well as what conclusions, if any, to draw from the purchaser’s location in the FTZ.

Example based on an interview with a bank compliance officer, 29 November 2019.

Understanding the risk:

The analysis of the risk factors will facilitate the bank’s assessment of how this situation can involve money laundering and how likely it is. For instance, the prevalence of cash use and reduced AML/CTF oversight in the FTZ increases the likelihood that an Eastern European organised criminal group deposits cash in a bank in the FTZ and uses it to purchase goods that are then resold in Eastern Europe under the guise of legitimate business operations.

Calculating the risk:

The FTZ’s risk score will reflect its overall risk profile and thus help determine whether enhanced due diligence is necessary.

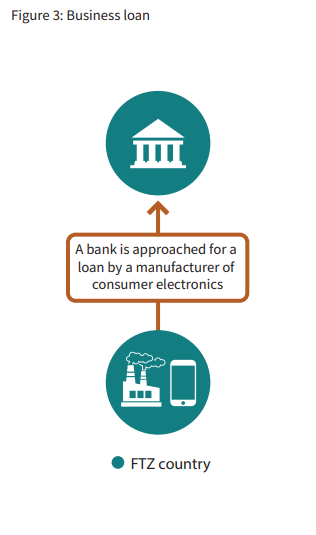

Example C – business loan:

A bank is approached for a loan by a manufacturer of consumer electronics. The manufacturer is incorporated in an FTZ in the same country where the bank is incorporated and operates.

The bank is a subsidiary of a global banking group. A group-wide policy requires treating FTZs as high-risk. In practice, there is little understanding of why that is the case and what additional information or documents from the manufacturer should be provided for the bank to adequately mitigate financial crime risks.

Example based on an interview with a bank compliance officer, 14 February 2020.

Validating the user’s risk assessment:

The FTZ’s risk score will help identify whether it is genuinely high-risk and therefore make sure that the bank correctly applies the risk-based approach.

Understanding the risk:

The analysis of the risk factors will help the bank establish how this FTZ is most likely to be used for criminal purposes and the extent to which these concerns are relevant in the customer’s situation.

Financial institutions – insurance companies

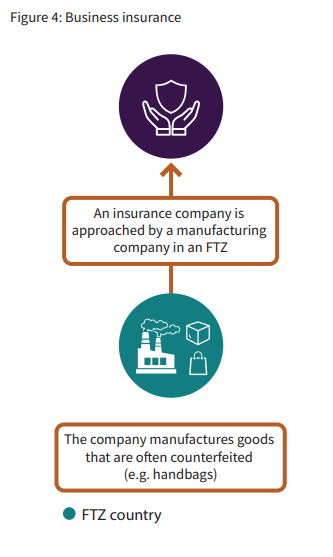

Example A – business insurance:

An insurance company is approached by a manufacturing company in an FTZ. The company manufactures goods that are often counterfeited.

The insurance company wishes to understand if the potential customer poses a high risk of being engaged in counterfeit production and is therefore requesting insurance for an illicit business and is likely to pay insurance premiums out of the proceeds of crime.

Understanding the risk:

The analysis of the risk factors will facilitate the insurance company’s assessment of how likely counterfeiting activities are to take place in this FTZ.

Calculating the risk:

The FTZ’s risk score will reflect its overall risk profile and thus help determine whether enhanced due diligence is necessary in relation to the insurance company’s customers incorporated or operating in the FTZ.

Example B – trade insurance:

An insurance company is approached by a trading company incorporated in an FTZ. The trading company wishes to insure a shipment originating from the FTZ.

The insurance company is aware of public-source reporting of illicit trade and sanctions evasion involving that FTZ. It therefore wishes to assess the risk of the trading company being involved in criminal conduct and the insurance company therefore being asked to insure shipments of illicit products.

Calculating the risk:

The FTZ’s risk score will help ascertain how likely the FTZ is to be used for illicit trade and/or financial crime, including sanctions evasion.

Transport Intermediaries – shipping lines and freight forwarders

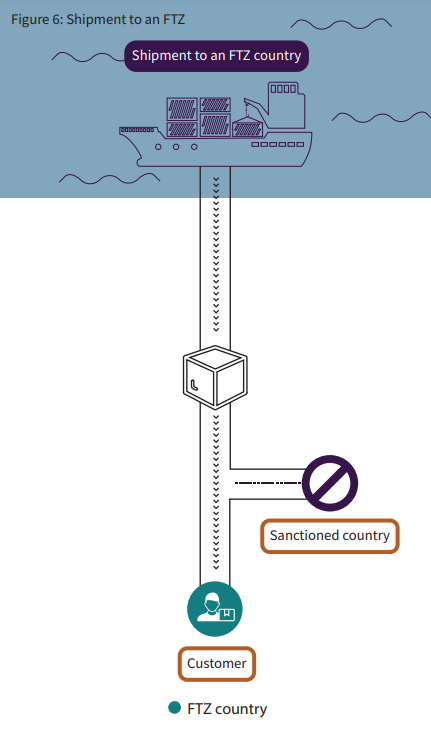

Example A – shipment to an FTZ:

A shipping line is contracted to ship (or a freight forwarder is contracted to organise the delivery of) certain goods to an FTZ.

The FTZ is in geographic proximity to a country subject to sanctions in multiple countries where the shipping line (freight forwarder) operates.

The shipping line (freight forwarder) wishes to ensure it is not being used to ship goods to a sanctioned country.

Example based on an interview with a shipping company compliance officer, 14 February 2020.

Understanding the risk:

The analysis of the risk factors will facilitate the user’s assessment of how this situation can involve sanctions evasion and how likely it is.

For instance, sanctions evasion is more likely if the goods in the FTZ are only subject to limited customs scrutiny and the users operating in the FTZ do not undergo effective due diligence.

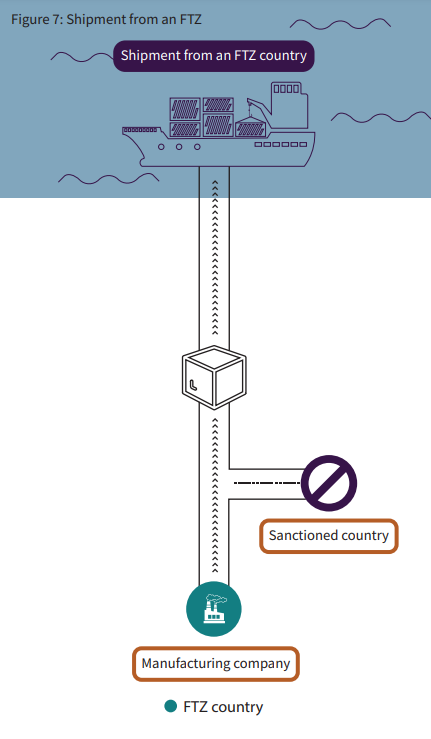

Example B – shipment from an FTZ:

A shipping line is contracted to ship (or a freight forwarder is contracted to organise the delivery of) certain goods from an FTZ.

The FTZ is in geographic proximity to a country subject to sanctions in multiple countries where the shipping line (freight forwarder) operates.

The customer is an FTZ-based manufacturing company that claims to have produced the goods in question in the FTZ.

The shipping line (freight forwarder) wishes to ensure it is not being used to ship goods from a sanctioned country.

Understanding the risk:

The analysis of the risk factors will facilitate the user’s assessment of how this situation can involve sanctions evasion and how likely it is.

For instance, if no significant manufacturing activities take place in the FTZ, sanctions evasion is more likely in this instance.

Example C – identifying high-risk areas:

A shipping line or freight forwarder is designing a sanctions compliance policy in line with the requirements of the US Treasury’s ‘Sanctions Advisory for the Maritime Industry, Energy and Metals Sectors, and Related Communities’ of 14 March 2020. Among other things, the Advisory reads as follows:

We recommend that persons conducting any transportation or trade involving the maritime sector (…) exercise heightened due diligence with respect to shipments that transit areas they determine to present high risk.

The shipping line or freight forwarder regularly delivers goods to and from a number of FTZs (or, in the case of the freight forwarder, organises their delivery). To ensure effective compliance with US sanctions requirements, it wishes to identify which of those FTZs should be treated as presenting high risk of sanctions evasion.

Calculating the risk:

The risk assessment tool generates an FTZ’s overall criminal risk score. It is not as such specific to sanctions compliance. However, identifying FTZs that are high-risk overall can be used as a first step towards identifying those of them that are high-risk from the standpoint of the user’s sanctions compliance.